If you’re thinking about going freelance, this post is for you. Becoming self-employed (‘sole trader’) may seem daunting… but don’t panic, the process is relatively straightforward in the UK. Here’s what you need to know.

So let me guess: you’re tired of working for your company and you’re thinking about going freelance. Or perhaps you want to keep your job, but start a small business on the side to get some extra income.

Whichever it may be, don’t worry, I totally feel you. I’m a UK-based freelance translator-interpreter who had this same dilemma years ago, so at some point I also had to find out how to go about.

I am more than happy to share my personal experience on this topic, so in this post I will cover – in 5 simple steps – what you need to do in order to become self-employed in the UK.

Although this blog focuses on Translation and Interpreting, I confirm that the information below should apply to pretty much every freelancer regardless of their specific trading area.

Disclaimer: Nothing in this post constitutes financial or tax advise. I am not a financial expert and I cannot be held liable for any actions you take as a result of reading this post. The contents of this post simply reflect my personal experience as a self-employed worker in the UK. While the information is believed to be true at the time of posting, it may contain errors and/or inaccuracies. Info that is accurate today may also become outdated down the line, as HMRC’s rules may change over time. Always do your due diligence before starting trading as a freelancer.

— Step 1 —

Start Selling Your Services

Yes, step 1 is just that: start selling your goods or services and get paid for them. You don’t really need any formal paperwork or authorisation for that (at least for the vast majority of activities), so simply put your hands to work and start getting some income.

You should aim to treat your activity as a legitimate business from day 1. Setting up a professional website to advertise what you do and showcase your skills to potential clients might be a good idea at this stage.

As we’ll see below, the next step will then depend on a number of factors, the most important being your turnover. However, in the first stage the key to start is literally just start.

— Step 2 —

Determine Whether You Need to Register As Self-Employed

In the UK, if you work for yourself in any shape or form by selling goods or services, you are technically running a business. So you need to ask yourself whether that applies to you.

Are You Running a Business?

It’s important to keep in mind that running a business need not be a full-time activity. Even if you have a regular job (in which you receive a salary via the PAYE system) but make some additional money on the side by selling goods or services, that’s considered to be a business.

In other words, you can be an employee for a company AND self-employed at the same time.

Either way, as long as you’re selling goods or services a) on a regular basis and b) to make a profit, chances are you are trading and need to pay attention as to whether you must declare your earning to HMRC by registering as self-employed.

Do You Need to Register as Self-Employed?

First, keep in mind that there are 3 main ways in which you may run a small business. Think of it as 3 different ways to legally structure your business: Limited Company, Business Partnership and Sole Trader.

Limited Company

It involves creating a separate legal entity for your business. As explained by Companies House, the owner of a limited company ‘will not be personally liable for any financial losses made by the business.‘

If you own a limited company, then technically you are NOT self-employed: you are both the owner and an employee of the company.

This option can be somewhat burdensome to run and only tends to make sense if your income is high enough to justify it, which often isn’t the case when you’re starting out as a freelancer – for that reason I won’t be covering it in this post.

Business Partnership

A simplified alternative to a Limited Company if you’re starting a business with someone else (either an actual person or a limited company.) This is not an option if you’re all by yourself, so I also won’t cover it here.

Sole Trader

As a freelancer, this is the simplest, most common way to legally organise your business. It involves getting registered in the HMRC for Self Assessment – that’s how you will pay your taxes. While it does not offer the same protection as a limited company in terms of liability (in the sense that you are personally liable for any losses made by your business), it’s usually the way to go for most freelancers.

The remainder of this post will focus on setting yourself up as a sole trader, and ignore the 2 previous options.

So to sum up, if you are running a business in the sense we covered above, chances are you need to get registered as a sole trader.

However, before we jump into that, be aware that, depending on the exact income you get from your freelance activity, you may not need to carry out any registration at all. That’s because of what is know as the tax-free trading allowance.

If your freelance gross earnings don’t exceed the trading allowance, then you don’t need to register for Self Assessment or even declare that income. (Source: HMRC)

Are You Making More Than The Annual Trading Allowance?

The trading allowance for the 2019-2020 tax year is £1,000.

You don’t need to register for Self Assessment if you’re running a business and you draw a gross income of £1,000 or less from that business. You also don’t have to declare that income: if it falls under the trading allowance, then it’s tax-free.

However,

You MUST register for Self Assessment if you’re running a business and you draw a gross income of £1,001 or more from that business. You must declare your income on a tax return.

This is an important point to keep in mind, and you can read more about it here.

Now, if you do make more than the trading allowance (which I hope you do), then it’s time to move on to step 2: getting the actual registration as self-employed done. Let’s see how that works.

Note: The registration process may be different if you work in construction or if you’re a self-employed fisherman.

— Step 3 —

Get Registered For Self Assessment

Now that you’ve determined that you need to register for Self Assessment in order to declare your earnings as a sole trader to HMRC, it’s time for you to take care of that.

Please note you don’t necessarily need to register straight away. By law, that must be done by the 5th October of your business’s second tax year (Source: gov.uk). Still, I personally think it’s best to just get that done the moment you know you’ll earn more than the yearly trading allowance.

To register for Self Assessment, first you need to have a National Insurance number (‘NINo‘.) This is a necessary condition.

Have You Got a National Insurance Number?

If you haven’t got a National Insurance number yet, then you must apply for one first. Make sure you do that here before registering for Self Assessment.

If you’ve already got a National Insurance number, then you can register for Self Assessment here.

Filling Up The Registration Form

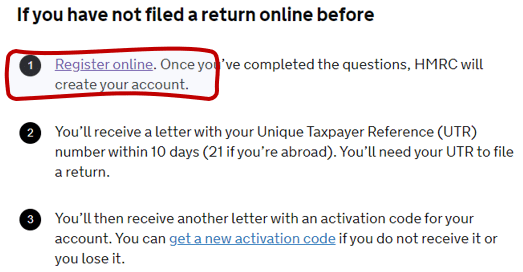

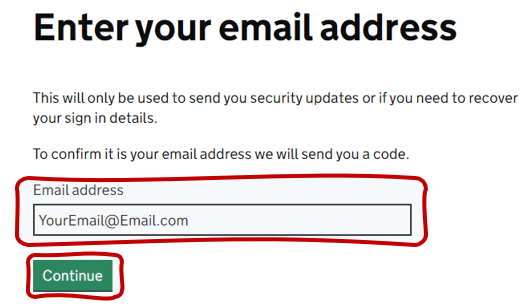

Once you’ve entered the page, click 1-Register Online, type your email address and click Continue:

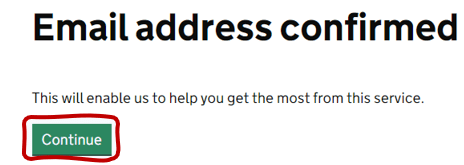

A registration code will be sent over to your email: all you have to do is insert that code and click Continue. You should see a confirmation message like the one below – click Continue once again to carry on.

The website will now ask you the following details:

- Your full name

- Set up a password

- Set up a recovery word

You will then receive a Government Gateway user ID. Keep this in a safe place – you will need it every time you log in to the Gateway. Click Continue again.

Next, you should see a page like the one below. Select ‘I want to tell HMRC that I am in business and need to register for a new tax (…)‘ and click Next.

The following pages will contain important information and instructions about the form you are about to fill up. Make sure to read everything carefully before clicking Next.

Eventually, you will get to the page below. Select ‘Self Assessment (including Class 2 National Insurance contributions)‘ and click Next.

Note 1: If your business’s taxable turnover is more than £85,000, then you must also tick the ‘VAT‘ box. VAT registration is compulsory above that threshold (Source: gov.uk). You can register for VAT even if your turnover is below that amount, but in that case it’s optional (always do your due diligence to determine whether becoming VAT-registered makes sense to your specific circumstances.) Most sole traders I know are not VAT-registered.

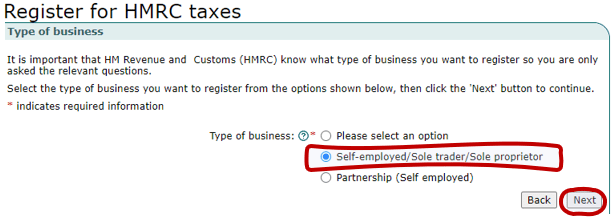

Next page, select ‘Self-employed/Sole trader/Sole proprietor‘ and click Next.

You’ll now be asked to provide HMRC either with the date in which you’ve started trading or the date in which your business’s revenues have exceeded the trading allowance.

The following page contains some additional instructions. In specific, you’ll be asked to have the following details at hand:

- National Insurance Number

- your full name and date of birth

- contact details

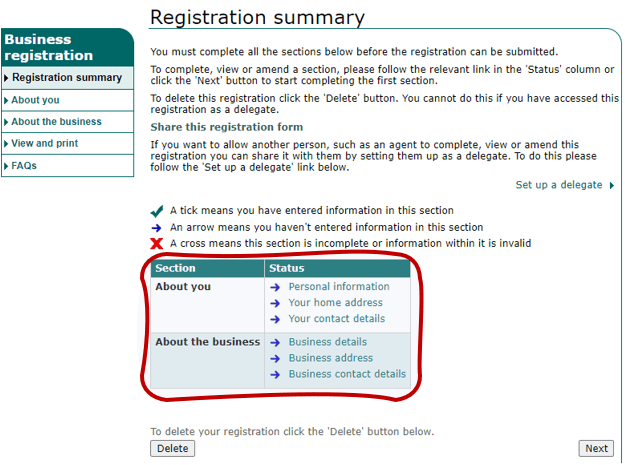

Finally, you should see the following registration form. You’ll have to provide all the requested particulars about yourself and about your business.

Keep in mind you don’t need to fill up everything in one sit. You may complete some parts and save your progress for later. Just make sure everything is completed and the form is submitted within 90 days, otherwise your progress will be erased.

Get Your UTR Number

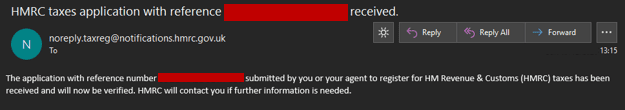

After submitting the form, you should receive a confirmation email just like the one below:

Allow HMRC some weeks to issue your Unique Taxpayer Reference (UTR) number, which will become the 10-digit reference code associated with your business for tax purposes. This should be received in form of a letter, so keep an eye out for your mail.

Note: Be aware that the UTR letter may take time to arrive – in my case it took more than a month.

Once you received your UTR you are all set up. Keep all your documentation in a safe place: you will need it again when it’s time to file your yearly Self Assessment.

— Step 4 —

Grow and Consolidate Your Business

Some of you might be thinking: ‘I’m officially set up as Sole Trader, so the hardest part is done, right?’.

Well… not really. The real hard work actually starts now.

From most perspectives, running a business – small as it may be – is a great source of stress. Full-time sole traders in particular are always walking on thin ice when it comes to income. Nothing is ever guaranteed, and sometimes it only takes one single event out of your control to severely compromise your livelihood (2020 crisis, anyone?)

If you’ve got a PAYE job and your business is just something you do on the side, then you are drastically reducing the financial pressure that running a business exerts on you. But even if that’s your case, you must also get ready for some serious ‘business headaches’.

First, although much less volatile than full-on self-employment, unfortunate things can also happen to the job market (hi again, 2020!); and secondly, you’ll have to handle your own taxes every year just like a full-time self-employed person does.

Growing and consolidating your business is an energy-draining, time-consuming affair – but it must be done.

This is a complex topic that deserves a full post in its own right, so I’ll just leave you with a summary of tips that will help you stay on the right track.

Create a Website For Your Business

If you haven’t had the chance to do this in step 1, it’s never too late to start. A professional website is extremely important for any business, as it allows you to present your services to any potential client.

It is possible to create a decent website with little resources and without much IT knowledge. This very same blog you are reading right now is proof of that: I’ve created this website despite the fact I know absolutely nothing about code and web design.

The investment is also not particularly prohibitive. A basic, but nice-looking and engaging website, will cost you less than £100 per year these days – and you should be able to deduct that amount as business expenses on your next self assessment.

Diversify Your Client Portfolio

Avoid overrelying on just a couple of clients. There was a point in my career where almost 90% of my turnover was coming from one single client, so every time they faced a down period I would also struggle as a result.

Diversification acts as a protection against risk: if clients A and B suddenly go silent, you’ve still got clients C, D and E to get work from.

Follow The 80/20 Rule

The 80/20 rule – also known as the ‘Pareto rule‘ – states that ‘80% of results will come from just 20% of the action‘.

From the perspective of a small business, this rule can be seen as an incentive to be wise when it comes to allocating your scarce resources in order to produce the best results.

Example: if you sell products A and B, but product A turns out to be more profitable to your business than B, then start producing more of product A and less of product B.

Always think of how you can maximise the outcomes by focusing on a smaller percentage of inputs.

Have a Contingency Plan

What will you do if you ever run out of money? Nobody wants to think about such a grim scenario, but think you must. Having a plan B is essential especially if you run a business, as you never know what tomorrow will bring.

If your goal is to become a full time sole trader (so that you’ll live exclusively off of your freelance income), do ask yourself the following questions as well:

- What’s your tolerance to risk and financial stress?

- How much money do you have saved? For how long would your savings last if you were to have some terrible months ahead?

- What sort of action(s) could you take to get more work during slow or negative periods?

Think Long Term

Sole traders running small businesses are often so focused on ensuring they are covered for the next month, they often forget to pay attention to the bigger picture.

Of course, you must ensure you have enough money for the near future, that will always be your most immediate priority. But you also need to consider how your life will be in 30 or 40 years time.

Don’t forget the long term. Start drawing a plan for later life as early as possible, either by starting a savings plan, joining a pension scheme, investing, or a combination of the three.

Also, ask yourself how you may improve your current condition in 5, 10 or 20 years time. There’s room for improvement in almost every profession, so don’t forget that long-term personal development is essential to a successful freelancer. Always think of new skills to learn and how you can perfect even further those that you already possess.

— Step 5 —

Learn How to Handle Your Taxes

One of the scariest parts about being a sole trader is handling tax. When you have an employer, everything related to tax is pretty much done for you. However, when you’re on your own, things are very different.

You’ve probably heard of Benjamin Franklin’s famous quote: ‘(…) in this world nothing can be said to be certain, except death and taxes‘. Failure to meet your tax obligation is likely to result in serious consequences, so make sure you keep a close eye on it.

If you feel unsure or nervous about it, consider booking a 1-hour meeting with an accountant in order to get some professional advice – it’s an investment that is likely to pay off.

For your reference, below I will list some of the things that you may want to do. Again, keep in mind that I haven’t magically become a financial expert all of the sudden, so please do your own research and don’t take my word for any of it. 🙂

Save The Dates (Tax Deadlines)

The tax year in the UK runs from April 6 to April 5 of the following calendar year.

Example: The 2019-2020 tax year started on 06/04/2019 and ended on 05/04/2020.

Self-employed workers must pay their taxes relative to a given tax year by January 31 of the following calendar year.

Example: The 2019-2020 tax year ended on 05/04/2020. You must pay your taxes relative to that tax year by 31/01/2021.

Important: The above applies to online tax returns, which is what most freelancers do nowadays. If you prefer handling everything by paper, then your deadline is tighter: October 31 of the same calendar year.

If you are filing your very first tax return, remember as well to register for Self Assessment by the 31th of October. That’s why, in my opinion, it’s best to simply take care of that the moment you exceed your trading allowance – you may get in trouble if you forget to take care of that down the line.

You can save this page to your browser’s bookmarks to check the official deadlines whenever you need. I’m pasting the most important ones for the 2019-2020 tax year below:

| Self Assessment | Deadline |

|---|---|

| Register for Self Assessment | 5 October 2020 |

| Paper tax returns | Midnight 31 October 2020 |

| Online tax returns | Midnight 31 January 2021 |

| Pay the tax you owe | Midnight 31 January 2021 |

Put Money Aside For Tax Every Month

Freelancing offers you a lot of things that a standard job can’t offer. It gives you the freedom to decide when, where and with whom to work, among other things.

At the same time, it also takes away several things that most people take for granted, with tax handling being one of the most obvious.

Make sure you get into the habit of putting a percentage of your monthly income aside for tax. Many new freelancers in their first year of self-employment forget to do that, so when it’s time to pay tax they don’t have enough money to fulfil they’re obligations (which colloquially translates to: ‘they’re screwed’.)

Creating a separate bank account just for tax may also be helpful. By having that money sitting on that account, you won’t be caught off guard when it’s time to pay tax.

Start a Retirement Plan

Another think most people take for granted is retirement.

According to UK law, employers must automatically enrol their employees into a pension scheme and take care of their monthly contributions to that scheme. In addition, the employer must top up that amount with an ‘employer minimum contribution‘.

To put it simply, when you have a job, in addition to having you taxes sorted out by your company, you are also building a retirement pot without having to do anything (unless you decide to opt out of the scheme, but that’s a different story.)

There’s no such thing when you are a full time freelancer. For that reason, it’s important to think of a plan as early as possible. Everything related to your retirement – and to tax in general – has to be done by yourself.

As soon as you have enough income coming in, start saving some extra money for yourself (on top of what you put aside for tax.) Building an emergency fund should be a freelancer’s utmost priority.

Remember that nothing is ever guaranteed: you may have an excellent month followed by 2 or 3 horrendous ones. Avoid getting caught in the cash flow trap by having 6 to 12 months worth of expenses saved.

Finally, no matter how far away that seems to be, start thinking about retirement today. You need to do your own research on this, or even speak to a professional in order to get advice. As already mentioned, your retirement pot may consist of savings, a pension scheme, investments, or a combination of the 3 – whatever is more suitable to your specific circumstances.

Conclusion

As you can see, becoming self-employed in the UK is relatively simple and can be done in 5 major steps.

Of course, while being simple is one thing, being easy is a totally different one. It all comes down to your current circumstances, your specific freelance activity and, ultimately, your personality.

If your tolerance to risk is very low and you enjoy the security of a regular job, becoming a full-time self-employed worker is probably not ideal. Nevertheless, you can definitely carry out some freelance work outside of your standard work schedule as a mean to generate some extra income.

On the other hand, if you value a higher degree of freedom more than you value the pros of a standard job, it may be worth considering full-time freelancing.

Either way, be prepared to work hard and to handle everything related to your business yourself. I am hoping this post will help kickstart your freelance journey.

If you’ve found this post helpful or think it could be useful to a friend who perhaps is – or is planning to become – a translator or interpreter, please kindly consider buying me a coffee by using the button below:

I put all my heart and soul into the content I produce in order to help my fellow linguists set foot in the industry. Most of what I do is available to everyone for free.

Donating is 100% optional, but greatly appreciated. A short espresso will do! ☕

Email Writing: How to Reply to a Customer Enquiry?

Email Writing: How to Reply to a Customer Enquiry?